Is Politics And Stock Market Related? CheckMan Explains How

Are you wondering why you witness stock market rumbles with government policy introductions? Don’t worry! This article will help you understand the plot.

The stock market is one of the central pillars of any economy, contributing a significant portion towards a country’s economic growth. Although stock markets around the world operate on identical terms, new policy changes or introductions by governments can impact their performance provided by Checkman.

Simply put, policies implemented by the government can either make or break stock market expectations. In short, stock prices, trade irregularities, and market trends can vary based on how the government implements new policies.

This article will highlight some key aspects that elaborate on the relationship between the stock market and politics.

Politics And Stock Market Go Hand In Hand

Although politics might have a limited effect on a country’s overall economy, you can witness politicians taking credit for positive changes in the stock market, especially when elections are around the corner.

However, we also cannot deny the fact that government policies can boost a company’s economic growth. So, you cannot blame politicians for taking credit for positive changes.

For instance, introducing new policies or altering existing schemes can give you a brief insight into the companies that will benefit from these government policies.

Furthermore, it also helps investors to forecast a company’s growth and help them make informed decisions to determine future profitability. In short, investors can evaluate a company’s performance after the government introduces new policies, increasing the chances of earning more profit.

For instance, if you consider a price hike in Apple shares, it indicates that investors believe in the company. On the other hand, if the shares decrease in price, the profit expectations will not allure many investors.

So, a positive change implemented with a newly introduced government policy is undoubtedly beneficial for various companies, as it helps them gain investors and earn more profits.

But what role does the stock market play between investors and companies? The stock market is the best way to evaluate expected performance, so you can consider it as a platform where you can get precise information about a company.

Furthermore, stock markets act as a bridge for understanding profitability, allowing investors to reap more benefits from their investments. So whenever the government implements a new policy, investors can establish precise economic outcomes based on the current stock trends of different companies.

What Can Stock Market Tell Us About Politics?

As mentioned earlier, the stock market and politics go hand in hand. So, you can understand a lot about politics by analyzing the current stock trends.

For instance, before the US presidential election in 2016, investors were anticipating significant political surprises based on how things were advancing between the two parties.

Investors knew that major policy changes were likely to accompany whichever party came into power, so most investors adjusted their expectations based on the anticipations.

Furthermore, the Trump administration looked more favorable than Clinton’s, which undoubtedly played a significant role in the former’s win. In fact, 9th November gave a major boost to financial services based on financial deregulation.

Companies gained higher benefits on their investments, even for those businesses that were facing stiff import competition. In short, Trump’s victory paved the way for many American companies to bloom.

However, the win also initiated certain policy changes and the introduction of new ones, which introduced various restrictions towards imports.

How Stock Market Performs Beyond Election Day

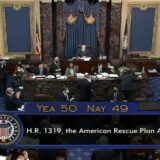

As mentioned earlier, the stock market relies significantly on political elections to anticipate the next trend in new policies. For instance, after Trump became the 45th US president, many companies expected major changes in different trade policies.

However, you have to consider different variables to judge a market’s performance, especially after presidential elections.

Here are some changes that you can expect after a US presidential election.

Low market returns

Although presidential elections ensure the introduction of new policies to boost the economy, you can witness low market returns the following year. On the other hand, bonds perform better than in previous years, making presidential elections work both ways.

In short, regardless of which party wins, the market remains identical. However, if the winning party has better plans for economic development, companies will undoubtedly witness positive results.

New ruling party

If a new party gets elected to power, many stock market experts estimate market gains at an average of 5%. Why? The new party takes its time to understand what the old party did during its regime, which can take some time to resolve.

Furthermore, a new party will have to ascertain the current market trends and implement or alter existing policies to get the maximum output. However, this process requires time and experiments, which means lower market returns.

On the other hand, if the new party capitalizes on existing policies, it can undoubtedly boost the economic growth and betterment of the entire country.

Re-elected party

If the ruling party gets re-elected to power, economic growth is always better than that of a newly elected party. For instance, many industry experts evaluate the average market gain of a ruling party at 6.5%, which is 1.5% higher than the average of a new party.

For instance, a re-elected party will know the pros and cons of its policies, which means it can work on its flaws to strengthen economic growth.

Furthermore, a re-elected party will have better experience regarding the current and future stock market requirements, which is undoubtedly beneficial for the stock market.

Which Stock Market Sectors Are Crucial For Politics?

Political parties keep a close eye on market trends to boost their campaigns. In fact, keeping a wide perspective on crucial markets is vital to perform well during elections, and most political parties utilize these assets during elections.

For instance, making significant changes and introducing positive healthcare policies will help their party stand out in the crowd, strengthening their political campaign.

Besides healthcare, infrastructure and defense sectors are also on the priority list for all political parties before elections.

Final Thought

If you structure stock market trends with politics, you will always find them interrelated. While politics may not enjoy overall control over stock markets, policies issued by ruling governments can make or break the deal for stock markets.

Besides, market expectations depend on how a new policy will work, which means that stock markets will always rely on politics, even if it has a limited effect.